Invest in Romania

In this article we will present you in detail the most relevant aspects and reasons why you should think to invest in Romania.

For the beginning we will try to familiarize you with some details about

Country Parameters

Romania is a democratic country since 1990, joined NATO in 2004 and EU in 2007. Standard & Poor’s credit rating for Romania stands at BB+. Moody’s rating for Romania sovereign debt is Baa3. Fitch’s credit rating for Romania is BBB-.

Location

Romania is strategically located at the crossroads of three major markets: European Union (EU), former Soviet Union, and Middle East and North Africa (MENA). It has access to the Mediterranean via the Black Sea Port of Constanta, as well as to the Danube. And it grows into a business hub for the rest of SEE.

Market size

Romania is the largest market in Southeast Europe (SEE) and second largest market in Central and Eastern Europe (CEE), after Poland. And, as the second poorest EU Member State with massive untapped potential, it can only grow.

Factsheet

Land area 238,391 sq km; 12th-largest in Europe

Population 19,511,000 (estimate 2015)

Main towns Population in ‘000

Bucharest (capital) 1,931

Timisoara 304

Iasi 317

Craiova 301

Constanta 306

Galati 297

Cluj-Napoca 306

Brasov 281

Climate Continental

Weather in Bucharest (altitude 92 metres)

Hottest month, July, 16-30°C (average daily minimum and maximum); coldest month, January, minus 7-1°C; driest month, February, 33 mm average rainfall; wettest month, June, 89 mm average rainfall

Language Romanian

Recognised minority languages Albanian, Armenian, Bulgarian, Czech, Croatian, German, Greek, Italian, Macedonian, Hungarian, Polish, Russian, Serbian, Slovak, Tatar, Turkish, Ukrainian, Yiddish.

Weights and measures Metric system

Currency Leu = 100 bani; the plural of leu is lei

Fiscal year Calendar year

Time Two hours ahead of GMT

Public holidays January 1st-2nd, January 6th, Easter (Orthodox calendar), May 1st, December 1st, December 25th-26th

About Economy and Key Economic Data

GDP AND GROWTH

Macroeconomic environment

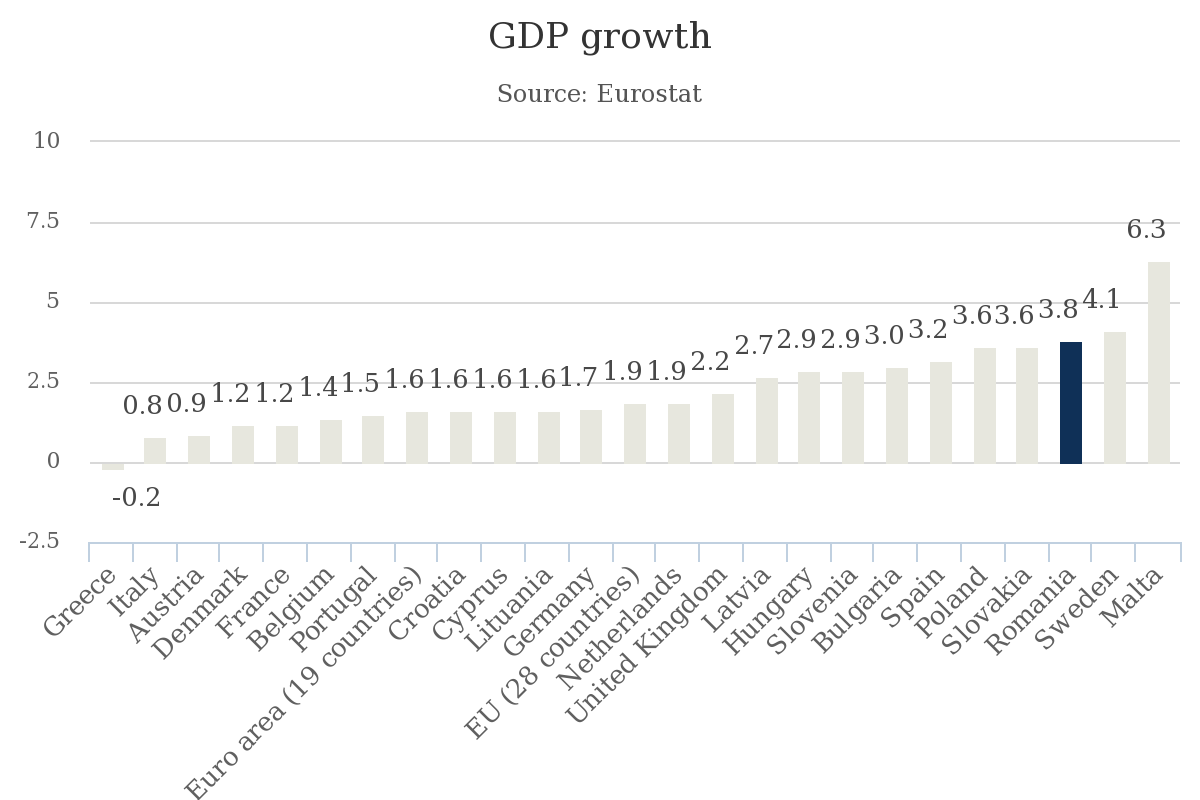

Overall, Romania’s macroeconomic situation is one of the strongest in EU in terms of real GDP growth, fiscal deficit and public debt, inflationary pressures and current account balance, with positive evolutions expected by some credit rating agencies. The output gap is projected to close in the 2nd half of 2016 amid strong recovery of the internal demand, especially in the private sector. The real GDP growth rate was 3,8% in 2015 Q4 compared with 2014 Q4, one of the highest in EU28, with forecasts maintaining a positive outlook.

Economic growth

However, economic growth has been robust since 2013, driven by strong exports and strong industrial production in 2013 and 2014. At the same time, a gradual recovery of domestic demand took place during 2014. Real GDP is estimated to have increased by 3.7 % in 2015 on account of surging consumption and recovering investment. In current prices, the nominal GDP is above EUR 160 billion according Eurostat.

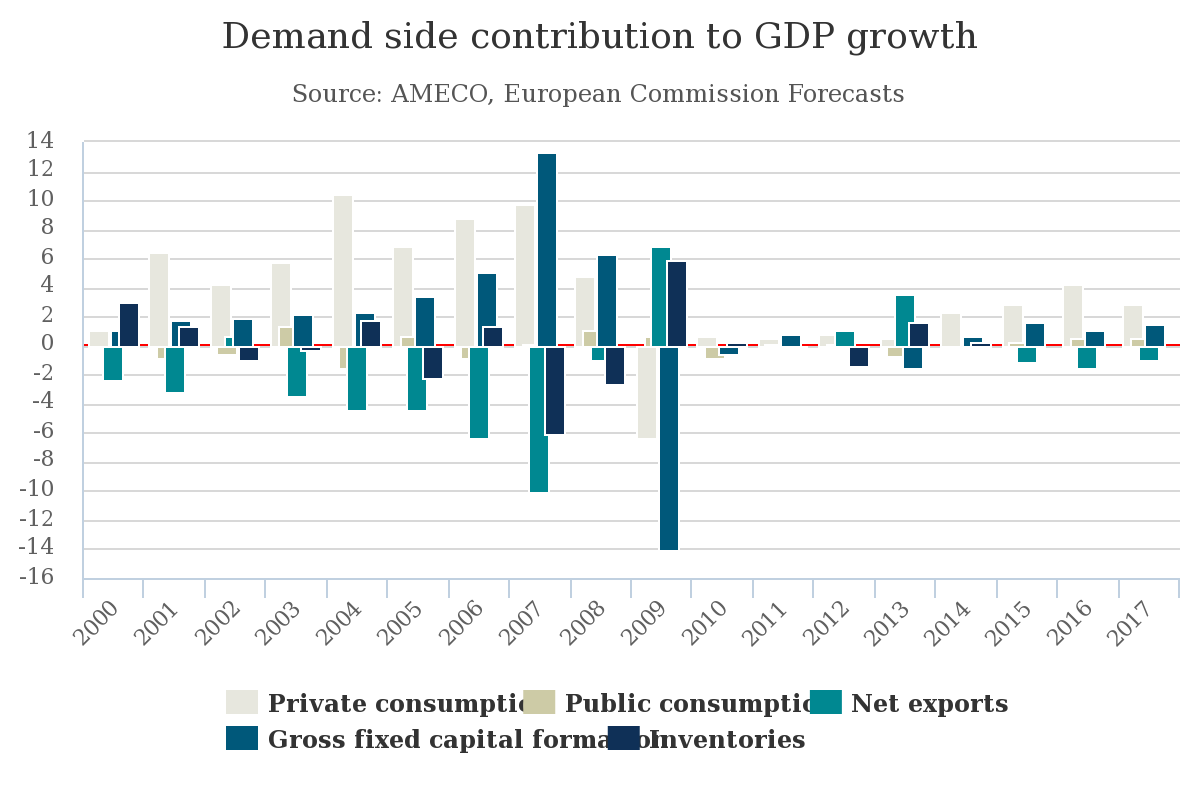

On the production side, growth was fueled by the recovery of two important sectors (construction and industry). In the same time, on the demand side there was a strong surge in private consumption and investment due to increases in wages and a decline in the standard VAT rate.

Economic growth forecast

Current forecasts estimate growth at 3,7% in 2017, according to the European Commission’s forecasts for Romania following the pro-growth fiscal policy, including tax cuts.

FDI – FLOW, STOCK AND MAIN SECTORS

FDI flow and stock

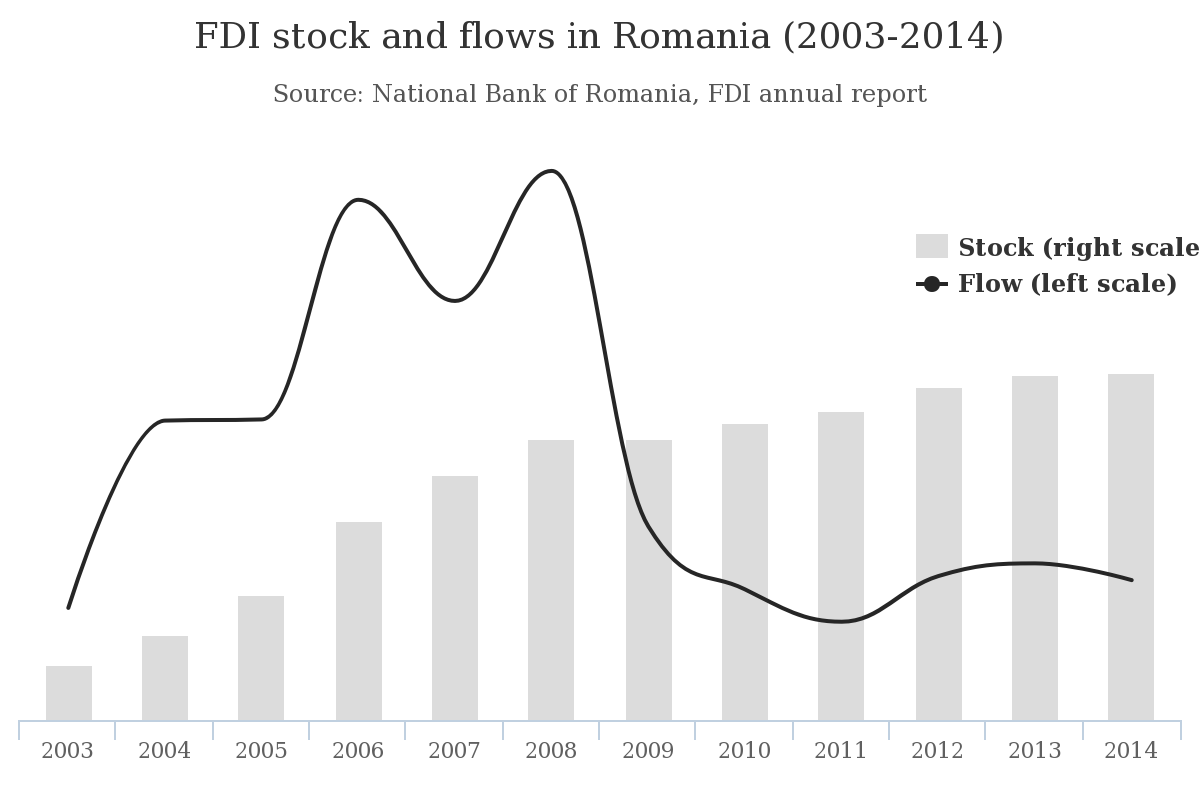

In 2014, FDI net flow stood at EUR 2,421 million. As in previous years, the FDI net flow went primarily to manufacturing (EUR 929 million), while the main sub-sectors benefiting from foreign direct investment were transport means (EUR 411 million), manufacture of computer, electronic, optical and electrical products (EUR 168 million) and metallurgy (EUR 158 million); other sectors reporting significant capital investment were construction and real estate transactions (EUR 646 million), information technology and communications (EUR 253 million) and trade (EUR 225 million).

At the end of 2014, final FDI stock reached above EUR 60 billion. On structure, equity (including reinvested earnings) of FDI enterprises amounted to EUR 43,2 billion (71.8% of the final FDI stock) and total net credit taken from foreign direct investors reached about EUR 17 billion (intercompany lending included) or 28.2% of the final FDI stock.

FDI stock by sector

FDI was channeled primarily to manufacturing (32.0 percent of total FDI), out of which the largest recipients were: oil processing, chemicals, rubber and plastic products (5.7 percent of total FDI), transport means (5.4 percent), metallurgy (4.5 percent), food, beverages and tobacco (4.0 percent), cement, glassware, ceramics (2.6 percent) and wood products, including furniture (2.5 percent).

Apart from industry, other activities that also attracted significant FDI were financial intermediation and insurance (13.0 percent of total FDI), trade (11.7 percent), construction and real estate transactions (9.8 percent), information technology and communications (6.0 percent).

About Investment Climate

Business Sectors

IT & C

The IT&C sector in Romania is considered as a primary growth driver with a year-on-year growth of 9% and forecasts that by 2020 it will be worth EUR 4 billion.

Global software companies such as Oracle, Amazon, IBM or Deutsche Bank already leverage the development potential of Romanian software developers at a fraction of the cost compared to Western Europe, while maintaining the product quality. They have also contributed to the initial development of the tech start-up environment that is developing today.

AUTOMOTIVE

The Romanian automotive market has been growing by 18% year-on-year average since 2009 and is forecasted to exceed EUR 20 bn by 2020. It is the 4th biggest automotive manufacturer in the CEE.

In the last decade more than 600 OEMs for automotive supplies opened plants in Romania following the investments of 2 big automotive manufacturers at Craiova and Mioveni.

AEROSPACE

At national level more than 30 players in the aerospace industry and auxiliary sectors have total revenues of EUR 400 million and more than 6,420 employees. In 2014, the gross profit of this companies was above EUR 60 million.

Other related activities covers repairs and maintenance of aircraft and spacecraft, engineering activities and related technical consultancy, manufacture of communication equipment, manufacture of textile articles …

AGRICULTURE

In 2007, Romania joined the European Union, marking a new era in the agricultural economy and rural development of our country. In this context, Romania had to quickly adapt their agricultural economy and rural development in order to integrate into the EU internal market and fully adopt the Common Agricultural Policy (CAP).

EU accession is probably the strongest factor of pressure for rapid reform of the Romanian agriculture and rural economy, given the need for successful integration into the European rural economy.

BIOECONOMY INDUSTRY

In the context of the new aim of the European Bioeconomy Strategy and Action Plan the development of the bioeconomy sector is a necessity for Romania in order to pave the way to a more innovative, resource efficient and competitive society, that reconciles food security with the sustainable use o renewable resources for industrial purposes. Romania has good perspectives in this field due to a great potential of the agriculture, increasingly growing standards of food industry, applied research in the pharmaceutical industry, safety …

CREATIVE INDUSTRY

Cultural and Creative Industries (CCI) sit at the heart of innovation in the economy profiling as a growing domestic hub and facilitator for many other value added sectors.

The sector has been growing steadily since 2009 with computer programming, information consultancy and services industry (– enjoying the biggest share) amongst the industries that generated the most added value created.

The activities covers Advertising, Architecture, Arts and Culture, Crafts, Design, Media, Sports and Entertainment, Publishing, Printing, Software

Educational & Skills

Professional education

Enrolment in professional education has risen constantly, which translates to a shorter transit from the classroom to the workplace.

At the end of 2014, a total of 156,345 people were enrolled in a form of professional education, 17% more than four years ago. At the same time, more than 74% of them were in post-high schools (97,640 individuals in 2014 compared to 20,000 in 2011).

A tremendous increase was observed in foremen schools, where about 50,000 individuals were enrolled in 2014 compared to 10,300 in 2011. Finally, smaller increases were observed regarding special post-secondary schools and special post-secondary schools – cycle 2.

University education

The quality of education in Romania is recognized internationally, local students consistently ranking in the top 10 in International Olympiad competitions in math and informatics, better than any other country in the EU.

The focus on technical subjects is significant, with the number of engineers/ capita higher than the US, India, China or Russia. Also, 99% of Romanian students learn two or more foreign languages in upper secondary education.

Technical degrees

Over 25% of graduating students will have a technical degree followed by approx. another quarter of students in business and economics.

With 5 polytechnic universities, 59 domain specific universities and 174 private colleges, the most successful students tend to pick high tech industries, such as IT – the local education system supplies over 7,000 IT&C engineers every year.

Romanian universities have been in the top 3 of the Institute of Electrical and Electronics Engineers Design Competition every year since 2001.

Employee specialization by main economic sectors

Romanian employees are mainly specialized in the Industry sector, about 28.5 percent of total employees working in this sector. At the same time, the Services sector hires about 25 percent of employees, coming in second place in the hierarchy regarding employees’ specialization.

The third most important sector in terms of Romanian employee specialization is wholesale and retail trade – including the repair of motor vehicles and motorcycles, with 7.7 percent of employees.

Wages & Salaries

Hourly Labor Costs

Overall, the hourly labor costs in Romania are around 5 euro/hour, representing 1/5 of EU average in 2015, where hourly labor costs is 25 euro per hour.

By sectors, total labor costs in Romania are among the lowest in EU, well below EU28 average in all activity sectors.

In 2015, mean hourly labor costs in industry was 5 Euro per hour (five times lower than EU28 average of 25,9 euro per hour); in construction sector was 3,6 euro per hour (six times lower than EU28 average of 22,4 euro per hour); in services of the business economy was 5,4 euro per hours (4,6 times lower than EU28 average of 24,9 euro).

At the same time, the highest hourly labor costs in Romania by sector in 2015 were found in sectors like mining and quarrying (11 euro per hour), financial and insurance activities (10,7 euro per hour) and information and insurance activities (10,7 euro per hour). However, sectors like accommodation and food service activities (2,8 euro per hour), arts, entertainment and recreation (3,6 euro per hour) and administrative and support service activities (3,6 euro per hour) are among the sectors with the lowest hourly total labor costs in Romania.

Minimum Monthly Gross Wage

In January 2016, 22 out of the 28 EU Member States (Denmark, Italy, Cyprus, Austria, Finland and Sweden were the exceptions) had a national minimum wage. According Eurostat, monthly minimum wages varied widely in EU Member States. Romania has the second lowest minimum wage, around 233 Euro per month, after Bulgaria (215 euro per month).

Tax

Personal income tax

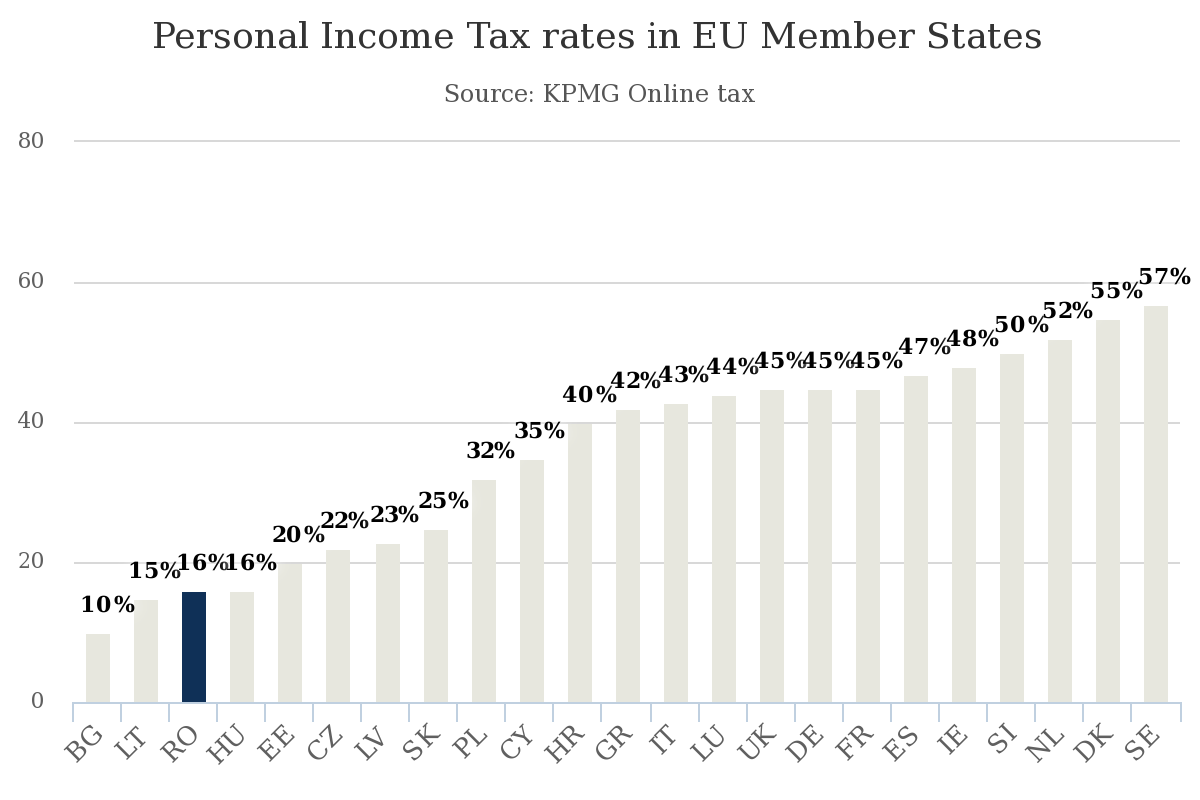

In Romania, personal income is taxed at a flat rate of 16%.

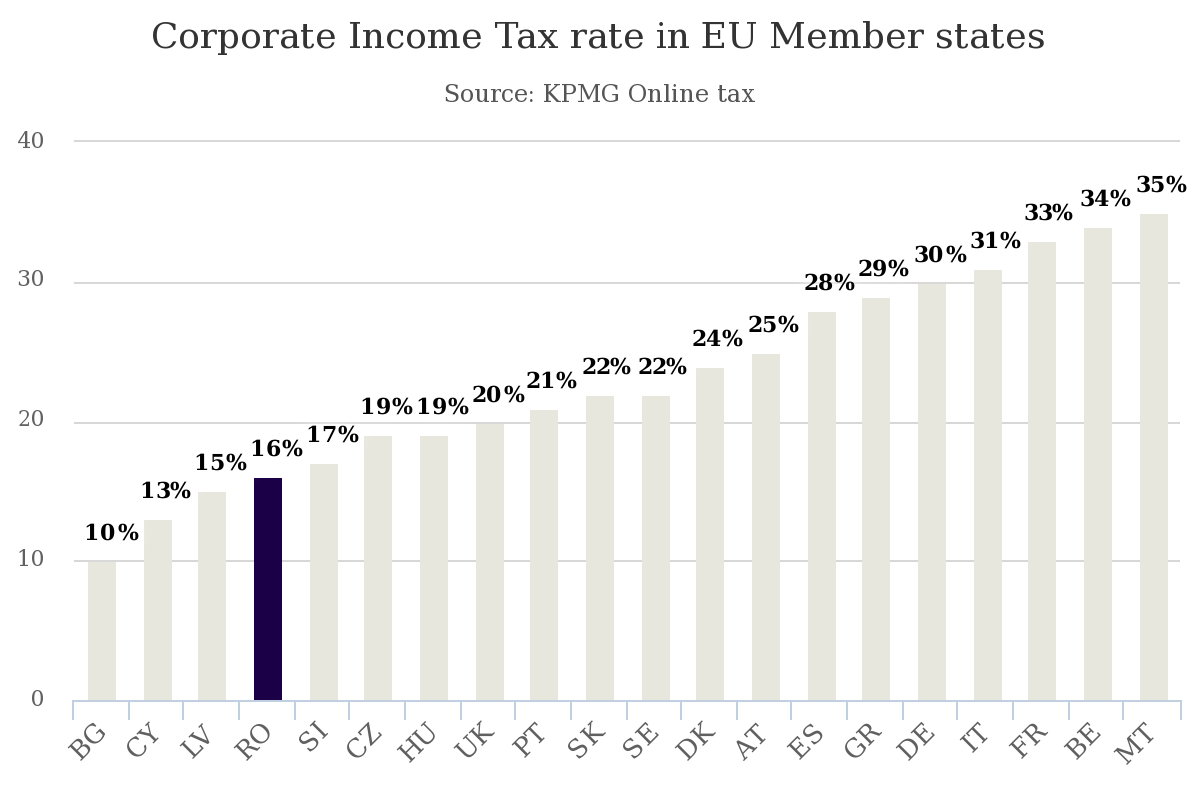

Corporate income tax

At the same time, the standard corporate income tax rate is 16%. Dividend income distributed as of January 1 2016 is subject to 5% income tax.

Regarding micro-companies tax, the threshold below which a company is classified as a micro-company is EUR 100,000. Also, a tiered system of micro-companies tax rates, depending on the number of employees, has been introduced. If you are a micro-company with two or more employees the tax rate is 1%, for micro-companies with one employee is 2% and for micro-companies with no employees the tax rate is 3%.

From 1st January 2017 the registration of a new company in Romania is Tax free. For more details please contact us here.

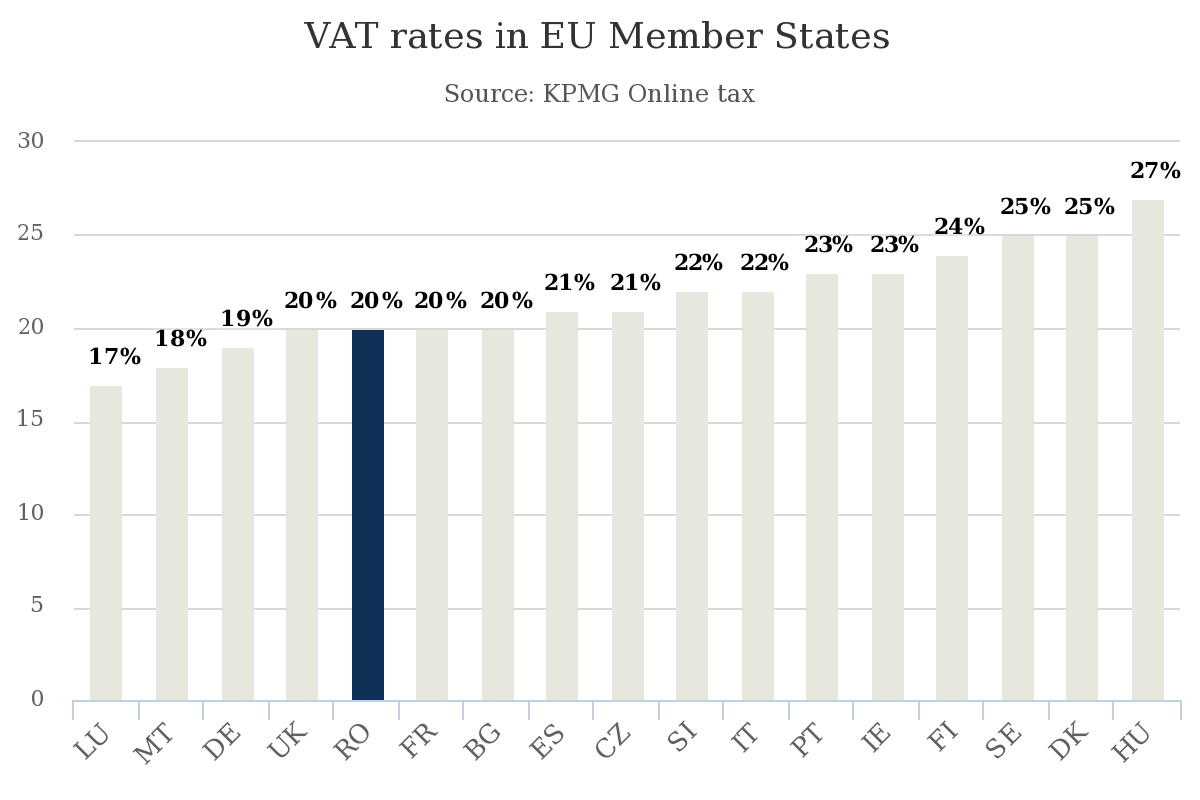

Fiscal incentives

The government is committed to reducing the tax burden. Starting with January 1 2016, the VAT rate was lowered to 20%, and it will be followed by another drop to 19% in 2017. At the same time, there are lower VAT rates on food items (9%) and some forms of entertainment (5%).

Regarding fiscal incentives, the Romanian fiscal code includes a 16% profit tax exemption for reinvested profits in new technological equipment used for business purposes and an exemption on the 16% income tax is available in Romania for employees working in the IT sector.

About Government Support

Pro-growth policy

Business confidence

Business confidence in Romania is at the highest level in the last 4 years due to robust economic growth prospects and to the recovery of investment and consumption.

Ease of Doing Business

According to the World Bank’s Doing Business Report, Romania is ranked 37th worldwide on the aggregate ease of doing business index, climbing 13 positions since 2014. The overall paying-taxes ranking of the country has been improving and is the second best among the regional peer countries.

From a tax perspective, the number of payments/ year required to fulfil fiscal obligations has dropped dramatically, from 113 in 2012 (historic maximum) to only 14 in 2016. Coupled with a tax system that is one of the friendliest in the EU, even more accessibility is the next step for growth.

Starting a business

In order to support entrepreneurs, the Romanian government has also simplified the process of opening up a business, reducing the necessary time from 29 days in 2004 to a little over a week in 2016.

Aiding emerging entrepreneurs

For the short, medium and long term, the government is committed to aiding emerging entrepreneurs.

The pro-growth policy has further implications for the Romanian business environment, with the necessary paid-in minimum capital decreasing by 2.3 percentage points since 2004, reaching a minimum historical value of 0.6% of income per capita.

Various fiscal incentives

The Romanian government offers a number of fiscal incentives that are aimed at leveraging the local technology and R&D capabilities by incentivizing investors and employers. For more details please don’t hesitate to contact us!

Investment Plan for Europe

European Fund for Strategic Investments

Is essentially an EUR 21 billion risk management tool designed to aid and facilitate investment from already existing capital pools in riskier project.

Was put together by the European Commission and the European Investment Bank.

Aims to mobilize at least EUR 315 bn in investment.

Support through the EIAH and the EIPP

The Investment Plan for Europe aims to help project promoters in the development of the financing application through the European Investment Advisory Hub.

Furthermore, as a means to connect projects with investors, the IPE has also built an European Investment Project Portal.

Regulatory environment improvement

One of the current priorities of the Commission seems to be the identification and elimination of regulatory bottlenecks that slow down investments.

State aid

Romania has some new interesting state aids for the national and foreign investors who want to invest or start-up a business here.

We hope this article was helpful for you and fulfil your interest regarding a possible investment in our beloved country.

Please note that this article is just a short preview of what opportunities you can find as an investor here in Romania.

If you want to go forward and start-up a business here, do not hesitate to visit our Services, Privilege Services or to Contact us.

source: #investromania.go.ro